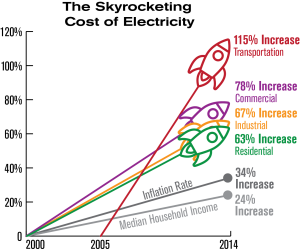

The property charges are one of the biggest item charges incurred by the property owners. However, many owners are not effectively appealing. Although owners recognize that property taxes can be imposed and reduced by appeal, some see taxes as an arbitrary calculation given by the government that cannot be effectively appealed. This appears to descend to the old saying, “You can’t fight the town hall.”

Fortunately, the Winston Salem property taxes appeal procedure offers owners multiple appeal opportunities. This process, which is either directly managed by the landlord or a property tax consultant, should entail a major effort to appeal and to reduce property taxes each year. Rising the most element cost has a significant impact on reducing the total operating expenses of the vendor. Although it is not possible to entirely avoid the burden of paying property taxes, taxes can be sharply reduced, often by 25 to 50%.

Some property owners do not appeal because either they don’t understand the process or because they don’t understand that there is a good chance that property taxes will be cut significantly. Many owners claim that because the market value of their property exceeds the assessed value, property taxes cannot be challenged and that. Although appeals on unjust assessment are relatively new, an administrative hearing on the grounds of unequal assessment specifically allows for the appeal of property taxes. The analogous evaluation takes place when the property is compared inconsistently with adjacent properties or related properties. Many owners still refuse to hire a real estate tax consultant, even though many consultants operate on a contingency fee basis, which is free of charge for the owner unless property taxes are lowered for the current year.

Requesting an appraised value notification

Property owners are entitled to request an appraised value notice for their property annually. This notification should be sent annually. The appraisal district does not have to give a valuation report if the value increases by less than $1,000. If, however, the owner was not satisfied with the value of a previous year and the value remained the same, a notice of value assessed for the current year will probably not be sent in the evaluation district. In this situation, the owner may forget to complain because a valuable notice was not issued for the land.

Many property owners and consultants begin with the actual revenues and expenditure data and use one or two of the assessment district assumptions. They use the information on their real incomes and expenses primarily in preparing their own income analysis and market value estimates for the property in question. As Benjamin Franklin wrote, “Nothing can be said to be sure in this universe except death and taxes.” You can’t avoid paying taxes, but you can choose to live and just make more money.

Since comparable sales are the main issue when assessing market value, the comparable sales data provided by the appraisal district relative to the assessed value of your property will be reviewed first. Convert the sales prices from the appraisal district on one foot or one device. So compare your revenue to your property per square foot or per unit assessment. During the hearing, sales can be helpful.