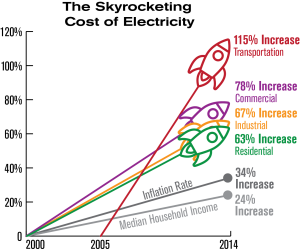

Like other products, the business sectors for energy, oil, oil and renewable energy are complex – and constantly evolving. Truth be told, most energy costs change every hour.

Key elements of money – such as the organic market – are less surprising, but when you include political and administrative variables such as monetary theory, determining energy costs can be very difficult.

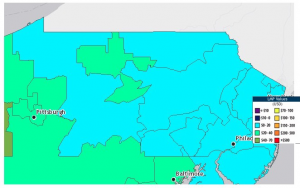

As one of the fastest-growing Flint Electricity Rates consulting firms in the country and a leading expert on energy supply in the Mid-Atlantic District, we monitor the business sectors daily, examine patterns and record this data to help our clients.

As we can say, here are the ten main factors that affect energy costs:

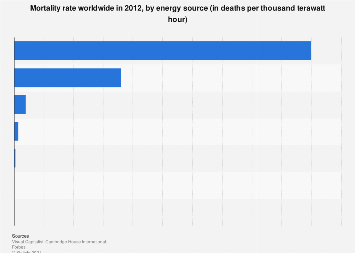

Deliver. Energy from nuclear, coal, gas, oil and renewable sources reacts quickly due to the unavailability of supplies (or the lack of such separation). This is a critical variable contributing to the cost changes that can occur with an hourly wage.

Pangayo. Interest in heating, cooling, lighting and cycles fluctuate due to interest in money, innovation and productivity measures.

Gas storage. This is a term for energy “stocks” (because you can’t store energy), such as the organic market difference. Gas injections and withdrawals are declared weekly and costs may also change.

Weather forecast. Expected weather conditions, such as actual climatic events, are important factors influencing the area’s market costs and transit agreements. If the estimate becomes a reality, it is less standard in terms of costs in the long run. Age changes. Although more limited, this development may affect business areas.

Atom. Withdrawal of more established plants because they require re-authorization can cause doubts.

Koal. Differences may also cause changes from a coal-fired power plant to gas oil to clean up the cost of innovation.

Transport. Across the United States, there are serious pipeline and electricity bandwidth requirements that require time and speculation to move. In the event of traffic disruption, costs increase.

Worldwide markets. Despite the enormous increase in shale gas production, significant changes in oil supplies around the world could affect US energy costs. Import and export. Global oil and gas costs determine which providers of relative benefits may be able to sell electricity locally or abroad. All energy costs are to some extent related.

Unofficial law. Government (FERC) and state (PUC) directives can quickly and generally change the cost of green markets, which, as confirmed above, affects energy costs. Money speculation. Like most other commodities, the price of energy can be completely affected by the monetary hypothesis, which is the most indirect variable of all. If the market does not seem to follow the exchange rate indicated by supply or demand factors, the cause is usually a monetary hypothesis, which is often unnoticed and causes a surprising development.

If you are not an experienced retailer, trying to cause urban chaos at the bottom of the market is an idiot. Reaching a qualified conclusion about the most likely current energy markets in the following is quite conceivable, with the help of a foreman, and your energy costs must be as short as expected. Of course, it is important to have a reliable and knowledgeable energy broker in the group. We will check the business sectors for you and help you comply with the prescribing decisions, which will ultimately cost you money.